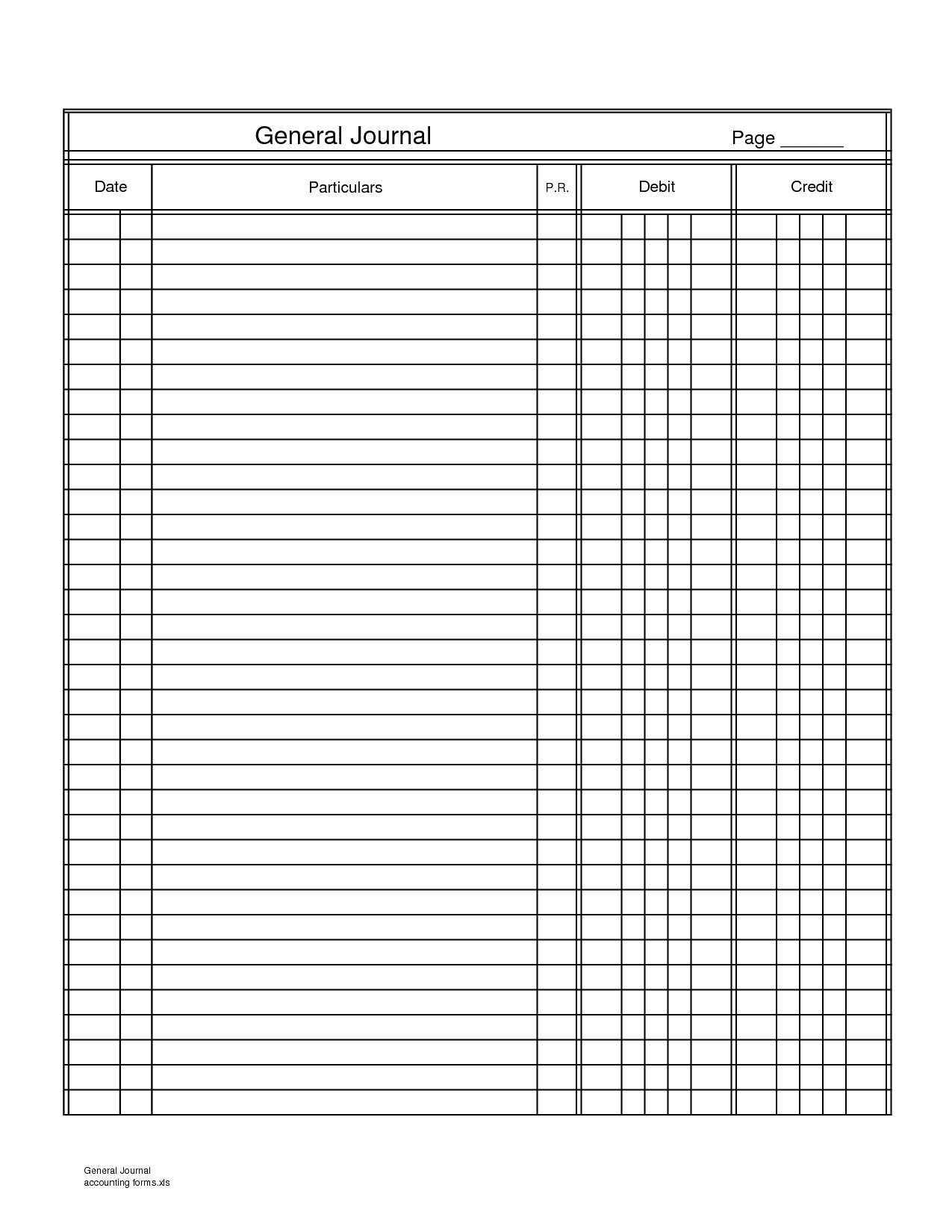

For account titles, we will be using the chart of accounts presented in an earlier lesson. [4] A substantial part of the programming and design was conducted by Edwin Woudt (first demo, SOX layers, UI) and Jeroen van Gelderen (message passing client architecture). [TB] A draft form of this paper credited Todd Boyle as an author, but this was later withdrawn at his request due to wider differences between the views.

Implementing Triple Entry Accounting as an Audit Tool—An Extension to Modern Accounting Systems

Double Entry bookkeeping arose in concert with thearisal of modern forms of enterprise as pioneeredby the Venetian merchants. Historians have debated whetherDouble Entry was invented to support the dramaticallyexpanded demands of the newer ventures then taking placesurrounding the expansion of city states such as Veniceor whether Double Entry was an enabler of this expansion. Very simple, but it was a method thatwas fraught with the potential for errors.Worse, the errors could be eitheraccidental, and difficult to track down andrepair, or they could be fraudulent.As each entry or each list stood alone,there was nothing to stop a bad employee fromsimply adding more to the list; even whendiscovered there was nothing to say whether itwas an honest mistake, or a fraud.

How To Depreciate Assets Using The StraightHow To Depreciate Assets Using The Straight

- Suppose the company’s owner purchases a used delivery truck for $20,000 on August 6 by making a $2,000 cash down payment and obtaining a three‐year note payable for the remaining $18,000.

- While there are many potential audit-IT points for blockchain technology, some of the key considerations include data governance and controls, identity management, and cryptography.Data governance and controls are essential for ensuring that the data stored on a blockchain is accurate and can be relied upon.

- A traditional database requires a centralised administrator to control the data/records and is also permissioned, which means the administrator sets privileges regarding how users can access a database.

- There are several different types of accounts that are used widely in accounting – the most common ones being asset, liability, capital, expense, and income accounts.

This method enhances the transparency and integrity of financial data by creating a verifiable and immutable record of transactions, often leveraging blockchain technology. The introduction of a third entry allows for more accurate tracking of assets and liabilities, reducing the risk of fraud and errors in financial reporting. triple journal entry Although they showed how tostrongly verify each transaction, they stoppedshort of placing the the digital signature in anoverall framework of accountancy and governance.A needed step was to add in the redundancy impliedin double entry bookkeeping in order to protectboth the transacting agents and thesystem operators from fraud.

Limitations, Discussion, and Future Issues

Thus, assets are decreased and immediately increased resulting in a net effect of zero. As you can see from the equation, assets always have to equal liabilities plus equity. The digitally signed receipt, with the entireauthorisation for a transaction, representsa dramatic challenge to double entry bookkeepingat least at the conceptual level.

Editing Services

However, accounting professionals and academic researchers lack adequate training on blockchain concepts and infrastructures. They hence do not possess sufficient knowledge and skills for effective engagement. On the other hand, for Blockchain to transform business processes (including accounting), blockchain experts will need more support from the accounting profession and finance professionals regarding specific business and accounting knowledge.

So what we now see is that massive amount of administration could be removed if we had an economy-wide accounting system. This will result in producing two corresponding and opposite entries to two different accounts, always resulting in an equal adjustment to assure the ledger is in balance. This is always the case except for when a business transaction only affects one side of the accounting equation. For example, if a restaurant purchases a new delivery vehicle for cash, the cash account is decreased by the cash disbursement and increased by the receipt of the new vehicle. This transaction does not affect the liability orequity accounts, but it does affect two different assets accounts.

The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article. The same procedure is followed for posting entries from double as well as triple column cash books to ledger accounts. The cash and bank columns of a triple-column cash book are used as accounts and are periodically totaled and balanced, just like in the case of a double-column cash book.

Triple-entry accounting allows us to reconcile the balance of transactions and reporting processes so the organizations can trust their own books. The idea about triple-entry accounting is instead of each firm having their own books, the transaction will go through a software program running autonomously which includes everything about that transaction. This may record what the product was, the prices, who the seller is, who is the buyer is, all digitally signed. This can also have a hash that links to further public documents so the books are now linked together by this third entry. The other exciting aspect is that this third entry could also be potentially be viewed for external reviewing or auditing purposes.

Every participant on a blockchain has a secure copy of all records and changes, so every user can see the provenance of the data by sharing all records. A blockchain database is decentralised, replicated and shared; it is a distributed ledger. The following example summarizes the whole explanation of the triple-column cash book given above. Auditing issues arise where constructionof the books derives from the receipts,and normalisation issues arise when areceipt is lost. This was derived simply fromone of the high level requirements, that of beingextremely efficient at issuance of value.

Blockchain technology was first proposed in 1991 by a group of researchers who wanted to create a system that would allow electronic documents to be timestamp-verified. However, it wasn’t until Bitcoin launched in 2009 that blockchain finally found its first real-world application. Actually, we simply transferred the amount from receivable to cash in the above entry.

There is a large body of science and literaturebuilt around these patterns of transactions.These have been adopted by the Business Processworkgroup of ebXML and other standards bodies,where they are called “Commercial Transactions.”Where however the present work distinguishes itselfis in breaking down these transactions into theatomic elements. Bookkeeping or accounting has its roots in ancient civilizations, some as old as 5000 years ago and therefore, we have evidence of Single-Entry Accounting even during the Mesopotamian era. However, it can dramatically reduce internal fraud and enhance a company’s operational efficiency.

Leave a Reply